There was a fun campaign by a reputed Indian Bank some time back where somebody gave a comment “Why Banks?” Well, this threw light upon two very common misconceptions: one that banks should not engage on Facebook and other that B2B businesses and brands should stay away from social media platforms. These misconceptions arise from a perception that Facebook and other social media platforms might weaken or tamper the brand image. On the other hand, connecting with banks on Facebook is proving really beneficial for fans, especially the younger customers of today. There is increased engagement when the bank proactively listens, fans respond and share their experiences.

There was a fun campaign by a reputed Indian Bank some time back where somebody gave a comment “Why Banks?” Well, this threw light upon two very common misconceptions: one that banks should not engage on Facebook and other that B2B businesses and brands should stay away from social media platforms. These misconceptions arise from a perception that Facebook and other social media platforms might weaken or tamper the brand image. On the other hand, connecting with banks on Facebook is proving really beneficial for fans, especially the younger customers of today. There is increased engagement when the bank proactively listens, fans respond and share their experiences.

Facebook is a platform that helps brands, be it banks; emerge as a friendly, trustworthy and approachable one. Twitter on the other hand is another wonderful social media tool that helps the brands to connect and interact in 140 characters.

Banks have actively taken a step to scratch the surface of the potential in social media. Study indicates that private banks are leading the race followed by a few large public sector banks.

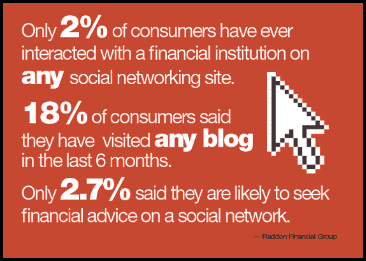

HDFC Bank tops the social media leverage index followed by public sector IDBI Bank, ICICI Bank, Axis Bank, Kotak Mahindra and Citi Bank. With social media leveraging brands and sectors across the globe, Indian banks are also realizing steadily that social media, when implemented with a strong strategy will not only prove to be important & profitable but build a long term identity and growth with large follower base and engagement. (Image Courtesy: Raddon Financial Group)

HDFC Bank tops the social media leverage index followed by public sector IDBI Bank, ICICI Bank, Axis Bank, Kotak Mahindra and Citi Bank. With social media leveraging brands and sectors across the globe, Indian banks are also realizing steadily that social media, when implemented with a strong strategy will not only prove to be important & profitable but build a long term identity and growth with large follower base and engagement. (Image Courtesy: Raddon Financial Group)

Globally, all the banks whether government or private have taken a wonderful step to stay connected with their customers through social media.

Sadly, there are a few banks that see social media as a platform to market their products instead of engaging with their customers and fans.

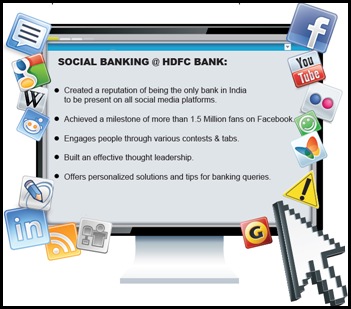

Although, HDFC is one such bank that has understood the importance and impact of social media and is doing pretty good in the banking sector.

HDFC, one of India’s first private sector banks commenced in the year 1994. To be a World class Indian bank, HDFC commenced with an objective to be the top provider of exclusive banking services. Catering to the business community primarily, HDFC has a very strong presence both offline and online.

If we talk about HDFC, their presence on social media has helped them garner a lot of customers followed by an amazing share of the market. HDFC took this social step with a simple strategy of Engage, Evolve and Excel.

In this social run HDFC is one such bank that stands out in terms of leveraging social media in terms of their presence in social media channels, the strategy they have implemented and their approach in engaging with their customers.

HDFC Bank is present on all the major social media channels namely Facebook, Twitter, YouTube, Foursquare, Pinterest, Linkedin, Google+.

HDFC on Facebook:

With more than 1.5 million likes, HDFC Bank’s Facebook page is mainly used as a space to push its marketing messages. Very actively they also started with Facebook advertising. With an amazing presence on Facebook, HDFC generates excellent feedback from its fans and followers. This not only helps the bank build a strong relation & trust with its customers but also serves as a basis for them to understand their needs and requirements.  It helps them promote their banking products and features too. They have recently come up with Taxpert, a tab where tax experts give their views and solve queries put across by customers. All sorts of financial news are provided to the fans through these sections on official Facebook page of HDFC Bank. They also engage their fans through contests, puzzles and finance related facts etc.

It helps them promote their banking products and features too. They have recently come up with Taxpert, a tab where tax experts give their views and solve queries put across by customers. All sorts of financial news are provided to the fans through these sections on official Facebook page of HDFC Bank. They also engage their fans through contests, puzzles and finance related facts etc.

The way they use their custom tabs is worth appreciating as they not only add value to their Facebook community but also direct the traffic to their Website.

They also give regular updates on latest deals & credit card tips on shopping. With this they also sustain regular conversations with customers and encourage repeat purchases on credit cards, in particular.

HDFC on Twitter:

HDFC Bank’s has two dedicated Twitter handles; one for customer query resolution and other to provide helpful tips to customers. For all sorts of queries & complaints customers tweet @ HDFCBank_Cares and the Twitter handle @HDFC_Bank provides useful finance tips, information related to tax and offers etc.

HDFC Bank’s has two dedicated Twitter handles; one for customer query resolution and other to provide helpful tips to customers. For all sorts of queries & complaints customers tweet @ HDFCBank_Cares and the Twitter handle @HDFC_Bank provides useful finance tips, information related to tax and offers etc.

Their approach on twitter is based on sharing interesting facts and information with their followers, engaging them through contests, puzzles followed by sharing products and deals they have to offer. They are very active on twitter, no wonder they are generating followers at a pace equivalent to their growth on social media which is commendable. The way they handle their customer queries deserves a hug applaud as their communication is not only considerate & explanatory but personalized. They now have a healthy follower count of more than 6.4k.

YouTube:

HDFC has conceptualized and created some of the amazing commercials which have paved their way through the YouTube channels. Also, they provide useful ‘How To’ videos for mobile banking, net banking etc. These commercials acquired a huge amount of viewership on their YouTube channel. Video content is very engaging & benefits the viewers. They are consistently trying to post and promote as many videos as they could to leverage their brand through YouTube.

HDFC has conceptualized and created some of the amazing commercials which have paved their way through the YouTube channels. Also, they provide useful ‘How To’ videos for mobile banking, net banking etc. These commercials acquired a huge amount of viewership on their YouTube channel. Video content is very engaging & benefits the viewers. They are consistently trying to post and promote as many videos as they could to leverage their brand through YouTube.

Linkedin:

HDFC’s company page on Linkedin has around 43k followers. They display their products and services on this page and get recommendations from the users which serve as a live testimonial. Being actively present on Linkedin helps users to browse the company details and employee information.

HDFC’s company page on Linkedin has around 43k followers. They display their products and services on this page and get recommendations from the users which serve as a live testimonial. Being actively present on Linkedin helps users to browse the company details and employee information.

HDFC bank’s official Pinterest page gives useful information about their exciting offers, products and latest trends in the Banking and finance industry. They innovatively motivate their fans and customers to keep pinning to their boards of interest in this space.

HDFC Bank on foursquare provides exciting offers & privileges tips for consumers to avail discounts with their HDFC Bank credit/debit cards.

In an initiative to amplify its services, HDFC leveraged this medium to spread their services, offers & discounts to its customers. They provide useful information to their fans through various properties they have on social media. The page has also crossed a milestone of 1.5 Million of fans.

HDFC deals with its customer issues very efficiently in a personalized manner and short time. Banking is a sector where a lot of care and precision has to be taken as it brings along with a great deal of negativity too. But when it comes to HDFC, it goes without saying that this bank has tried its best to keep the level of negativity as low as possible with its interactions, engagements and most of all its effective customer service team. They are doing a really great job with their social media efforts.

HDFC Bank is not only reaching out to their customers and fans through social media but also engaging them consistently with informative and interesting contests and tabs. They hold tax trivia and secure banking twitter contests wherein people are offered secure banking and tax related tips and learning about tax in a fun way. This not only helps them build effective thought leadership across the industry but makes them stand out for their social efforts.

How Banks should leverage Social Media?

Social Media is emerging as the new destination for bankers to reach out to a great range of their customers overwhelmingly. Before taking a step into the social media world, banks should pause to check out the security and regulatory issues related to banking. They want to embrace this newest way of connecting with consumers, but with care.

People are also keen to access banking services on social media therefore banks can effectively maintain a social media presence to garner more engagement with their services.

There’s a lot that a bank can explore on social media platform and further strike a trend in this sector. The trend of being on social media and show off the social credentials has already begun amongst the banks and is very actively moving ahead with rising competition in this space too.

Moving further, it is fairly evident that internet penetration on a global level is in an upswing and so is the use of smartphones. Social media is therefore shaping the future of almost all the future brands.

The need of the hour for banks is to leverage their brand interests, increase visibility of their offerings, increase interactions and place their customers in high regard. Banks are coming up with various mobile friendly apps that connect the consumers with the brand further helping them attract prospective customers. These apps act as a marketing device to promote offers and discounts.

Social Media, once strategically implemented marketing communication plans can help banks in some of the great things like: Community Building, Product Research, Customer Service, Marketing & Promotion and Transparency.

Once the banks implement social media into their marketing strategies, it would not only lead to improved branding, but they could also understand consumer perceptions about them, leveraged product research and a strong relationship building with customers. This also brings a great level of transparency to banking services. Banking and finance sectors, unlike the FMCG sector have one-to-one relationships with their customers. Social Media enables this engagement and motivates the brands to be accountable.

Making social media as one of the most important arms of customer support, educating and informing fans about the security issues & safe banking practices, encouraging the workforce, offer customized solutions gained from social media insights will surely go a long way in crafting social media banks of the future. One thing is evident that to be a successful brand on social media, brand managers and strategists need to evolve with variety of strategies keeping in mind the strong execution and sincere intention. In your opinion what can be further strategies by reputed banks on social media?